Project Description

Property:

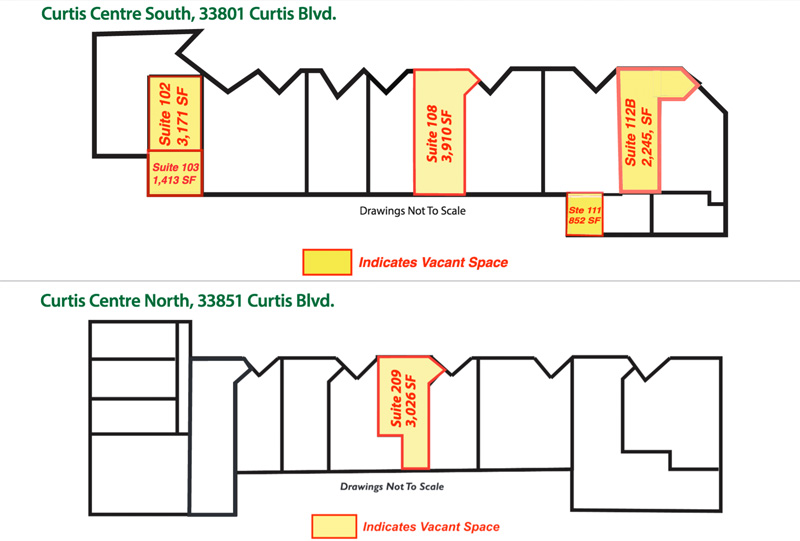

Curtis Buildings – 111,928 Square Foot Class B Multi-Tenant Light Industrial Buildings in Cleveland, OH

Issues Prior To Acquisition:

- Minor physical issues (roof/parking lot) with the property.

- Rental rates hadn’t been increased in 8 years and were on the low end of the competitive range.

- Functional obsolescence in multiple units

- Ownership wanted to focus on developing senior living facilities.

DVP Actions:

- Turned a shell, vacant suite that had not been leased for 6+ years into a fully functioning suite leased to a gym company with a nice buildout, bathrooms, and all utilities.

- Retrofitted main electrical service to both buildings

- Completed the planned parking lot resurfacing and restriping and sidewalk repairs

- Addressed major roof issues (the seller of the building contributed to these repairs)

- Completed 7 new lease or renewal deals, including two of our largest tenants.

- Completed the year at 92.6% occupancy, and are in discussions with two tenants currently that would bring it to 95.7%.

- Successfully shifted the property management to a firm more in line with our goals and objectives

Results:

The property was acquired at a 55% discount to replacement cost and a new property management company was installed immediately, along with over $150,000 of capital improvements. 70% LTV 10 year loan attained with a 10 year fixed term at 5.6%.

Projected Returns:

17% leveraged Return on Investment, 9.2% Cash on Cash on a 5-year average to investors. 9.0% Cash on Cash return to investors on Day 1.

Purchased for $3,600,000 (ask was $4,100,000) in 2015.